37+ when is your mortgage rate locked in

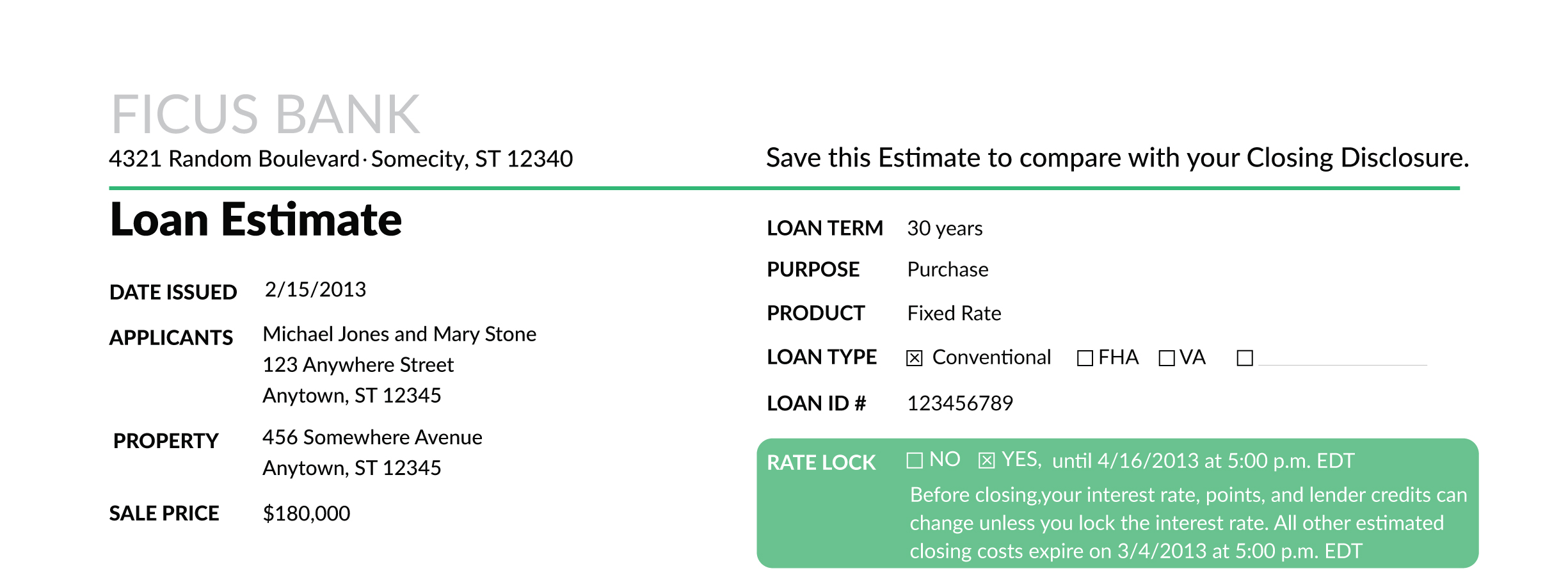

Once that period expires the borrower is no longer guaranteed the locked-in rate unless the lender agrees to extend it. Web Your lock should include the interest rate the total days of the lock typically 30 or 60 days and the points charged if applicable.

When Should I Lock In My Mortgage Rate New American Funding

Web Mortgage rates can change daily and a rate lock protects your interest rate from rising before closing as long as its within the specified time frame and there are no changes made to your application.

. Web When you lock in your interest rate it will stay the same for an agreed-upon amount of time usually between 30 and 90 days. Explaining a Mortgage Rate Lock When a borrower locks in an interest rate on a mortgage it should be binding for both the borrower and. After 45 days your rate might be as much as 025 or more higher especially with the Fed determined to aggressively raise interest rates in 2022.

Web Lock that in for 30 days and even if rates shoot up to 5 by the time you close on your home three weeks later your lock means you still get a loan at that sweet 4 interest rate. Web Rate locks are typically available for 30 45 or 60 days and sometimes longer. Some lenders do offer a free rate lock for a specified period.

If your rate is not locked it can change at any time. Web You can lock in your mortgage rate as early as when your loan is approved and as late as a few days before your scheduled closing. Find a local lender on Zillow What Happens if the Rate Goes up or Down After you Lock in the Rate.

Just a quarter point 025 rise in. Web Before choosing a lock-in period determine the average time for loan processing in your market. Web To protect you from rising interest rates lenders will offer a mortgage rate lock.

The Minimum Salary You Need To Be Happy in Every State. If youre having your home built sometimes it wont be completed for months. Web A rate lock period will typically be 30 to 60 days.

If youre getting a mortgage to build a home youll. Essentially youre guaranteed to have the same interest rate from the day you applied or got preapproved for as long as it takes to process your mortgage or 30 to 60 days. This will occur just as long as the home purchase closes within the specified time period and there are no changes to the borrowers loan application.

Web The exact lock period varies based on your loan type where you live the loan terms and the mortgage lender you choose. Locking in your rate right away can protect you from these rate hikes. And a rate lock may lock you out of a lower interest rate if rates fall after you get your loan offer.

Web Your lender might lock in a mortgage rate for a fee as a way to protect you from any interest rates increases while you shop for a home. Ask your lender to estimate the time necessary to process your loan and verify the information with other realty and mortgage professionals. Web Rate locks typically last from 30 days to 60 days though they sometimes last 120 days or more.

Web On refinances borrowers usually lock their rate after their homes appraisal is finalized. Have you found a lender yet. This means you wont need to worry about rates going up before your loan closes.

Most lenders will not charge to guarantee a rate for periods of 30 45 or 60 days. Web How Long Can You Usually Lock In a Mortgage Rate. When applying for a mortgage customers typically talk with their mortgage banker up front about rates.

Web When the interest rate is locked it will not change between the moment the buyer got the rate lock and the time of closing. This could save you a substantial amount of money if interest rates hike during the mortgage approval process. Web When rates are going up a mortgage rate lock is well worth the cost.

Web Most lenders wont lock your rate for less than 30 days unless youre ready to close and often offer the same rate for a 15-day and 45-day period. Locks average 30 days but can range from 15 to 60 days or more. In fact Zero Mortgage is an online.

Longer rate locks often cost extra for the borrower though recently some lenders have begun offering free extended lock periods to cope with the surge in volatility. Most rate locks have a rate lock period of 15 60 days. Many lenders will offer new construction rate locks for 180 days 270 days 360 days and more.

You usually can lock in a rate for 30 45 or 60 days. Web The most common time to lock in a mortgage rate is when you accept a loan offer. If interest rates rise after youve locked in your rate youll be able to stick with the lower rate.

In most instances you can lock your rate for anywhere between 30 and 60 days once your application is pre-approved although this timeframe could be much longer with some lenders. Web Usually a rate lock is good for 30 45 or 60 days though that time period can be shorter or longer. If youre looking to borrow its a guarantee that the rate youre given for your loan will stay the same until you close on your house regardless of market movement.

There can be a downside to a rate lock. Web A mortgage rate lock sometimes called rate protection allows you to keep the interest rate on your home loan from rising between the time you apply for a mortgage loan and the time you close. If the rate lock expires before your loan closes you may have the option to pay a fee to extend the lock period.

Once its locked the rate can adjust only if there are major changes to your mortgage application. Consider a 400000 home financed for 30 years at 7 with a 20 down payment. Web A mortgage rate lock allows you to keep your interest rate unchanged for a set period of time usually between when your purchase offer is accepted and when you close on your new home.

After that however even those. It may be expensive to extend if your transaction needs more time. It depends on the lender loan type loan terms and where you live.

Web Most rate locks run for 30 to 45 days and that amounts to an eternity in the interest-rate market. Ask about the rates for several lock. Web A mortgage rate lock is an agreement between borrower and lender that allows borrowers to lock in an interest rate.

7 Financial Habits That Improve Your Daily Life More.

West Valley View North Zone 09 21 2022 By Times Media Group Issuu

Upzsnya8jlshym

Mortgage Rate Lock How And When To Lock In Quicken Loans

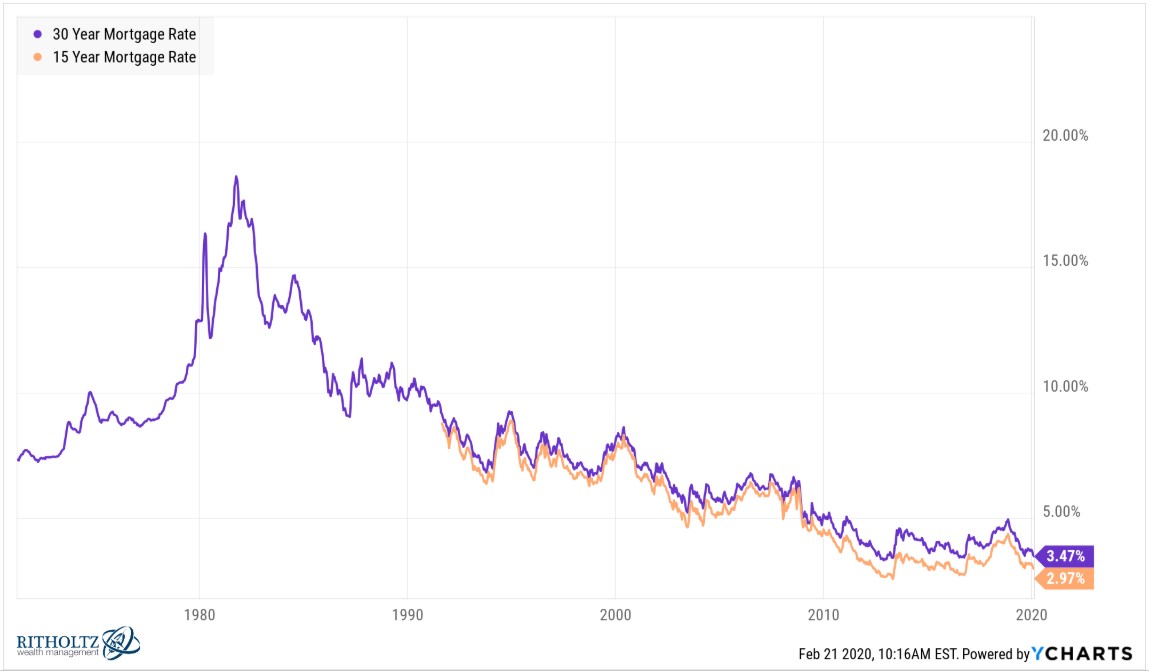

Should You Pay Off Your Mortgage Early With Rates So Low

Mortgage Rates Tumble As Lenders Face Increasing Difficulties The Washington Post

Mortgage Rate Lock When Do I Lock In My Interest Rate Nerdwallet

Mortgage Rate Locks What You Should Know Lendingtree

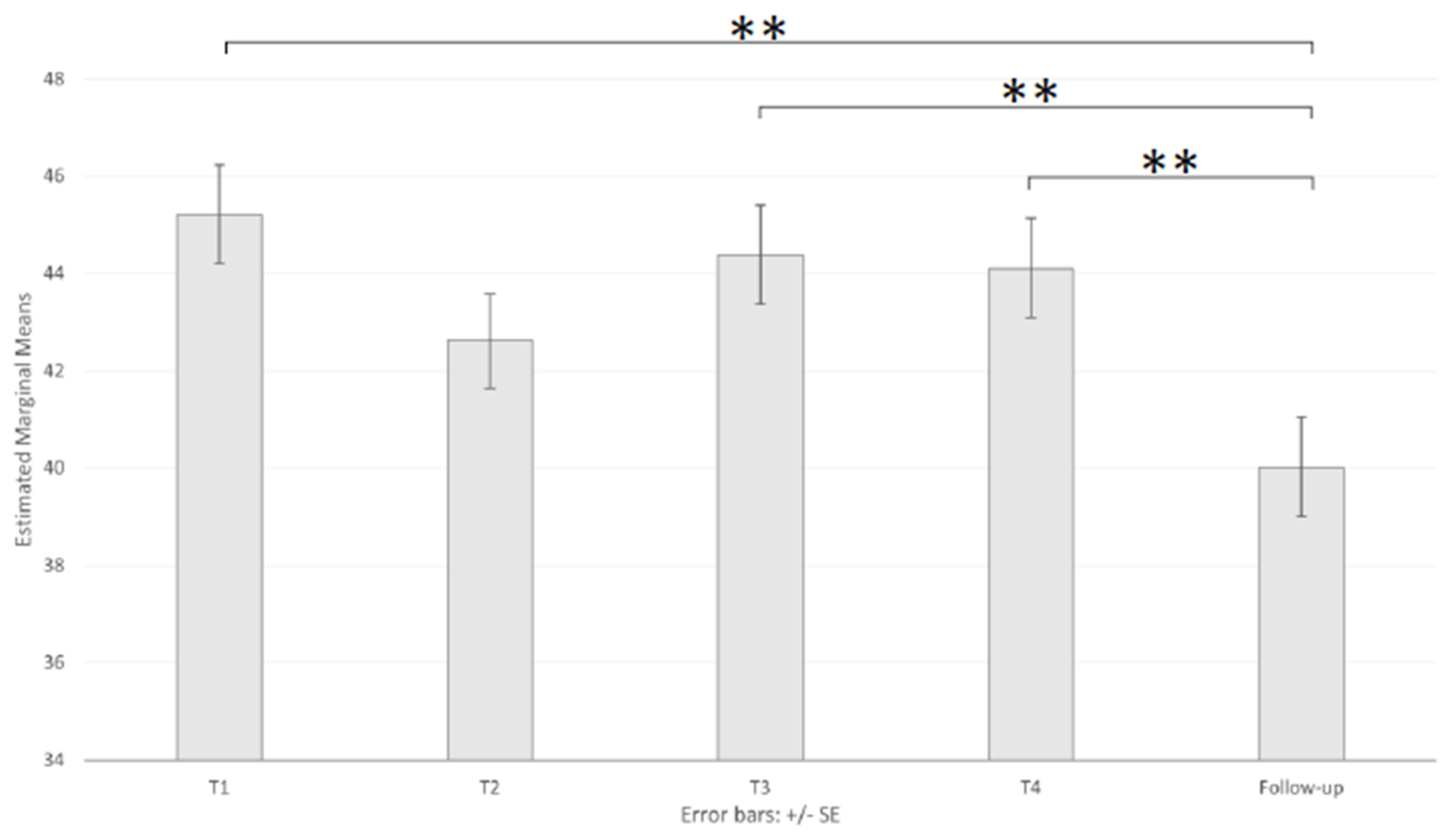

Brain Sciences Free Full Text Stay At Home In Italy During The Covid 19 Outbreak A Longitudinal Study On Individual Well Being Among Different Age Groups

Mortgage Rates In Redding Chris Lamm

Money Minute Should You Lock In Your Mortgage Rate

Can I Unlock A Mortgage If Interest Rates Drop 2 Strategies

When To Lock In My Mortgage Rate Chase

Der Schlachter Gegenstand World Of Warcraft Classic

Sweet Home Or Real Estate Homes For Sale Pg 4 Homes Com

Die Todesminen Zone Wotlk Classic

Mortgage Rate Lock Guide When To Lock In Rocket Mortgage

Hear Live Translations Of Over 37 Languages With These Earbuds On Sale